TABLE OF CONTENTS

Continuing EducationTHE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF THE ACCELERATION PROPOSAL, GRANTING THE COMPANY THE RIGHT TO FROM TIME-TO-TIME ACCELERATE THE EXPIRATION DATE OF LESS THAN ALL OF THE OUTSTANDING WARRANTS.

THE ADJOURNMENT PROPOSAL

In the event there are not sufficient votes for,

DirectorsThe Board has access to a number of resources to assist Directorsor otherwise in enhancing their skills and knowledge in current and evolving areas that are relevant to our business. The Company also pays for reasonable expenses associated with a director’s attendance at continuing education programs. The Board is also routinely briefed by external advisors on the macro and industry environment as well as other issue-specific topics throughout the year.

| | | | |

26 | |  | | 2023 Proxy Statement |

Board Refreshment and Succession Planning Process

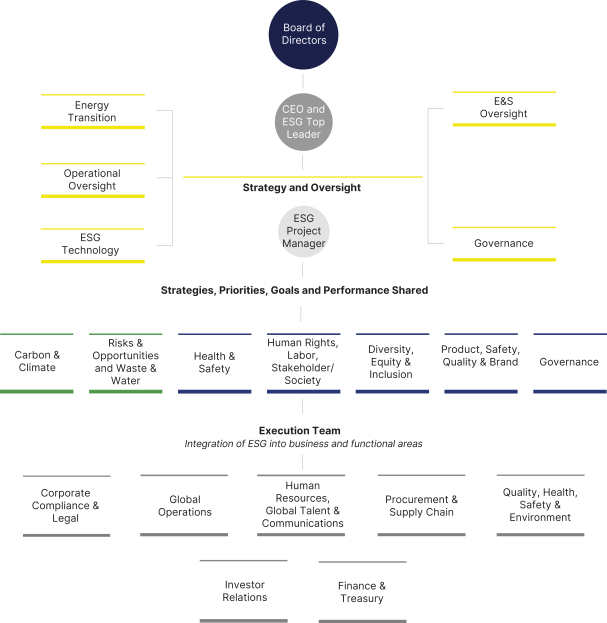

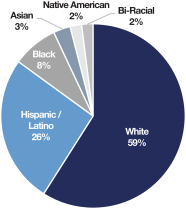

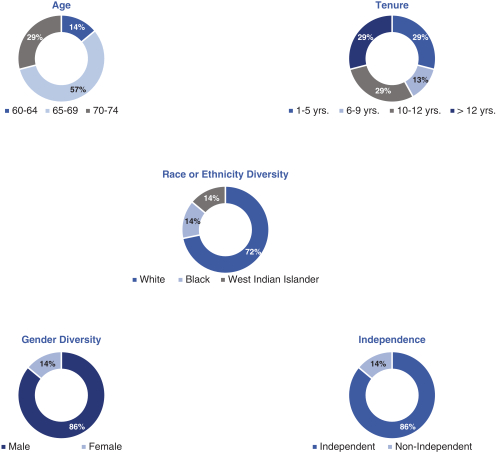

The Board routinely evaluates its composition to ensure that composition is alignedconnection with the needs of the Company’s business strategy. To support this process, the ESG Committee evaluates the skills, experience and capabilities of the Board in light of the Company’s strategy and considers how Board composition may evolve to address emergent strategic needs. In considering Board refreshment, the ESG Committee also takes into account diversity. The Board acknowledges the benefits of diverse viewpoints and experiences in the decision-making process. The ESG Committee has discretion to engage outside consultants to help identify candidates and also considers suggestions from shareholders.

In the more recent years, the Company has added two new Directors to its seven-person Board, Ms. Tanya Beder, who self-identifies as female, and Mr. Anthony Chase, who self-identifies as an underrepresented minority, both of whom bring diverse perspectives. The Board also has an established practice of rotating membership of key Committees as well as rotating Committee leadership positions to allow for fresh perspectives. In furtherance of this practice, in 2020 Michael Linn stepped down as Chair of the Compensation Committee and Tanya Beder assumed the role. The Board additionally refreshed the chairs of the ESG and Risk Oversight Committees.

Director Nominees

| | | | |

| | Tanya S. Beder

Independent Director

Director since: 2017

Age: 67

| | Committees: Audit, Compensation (C), Technology and Safety

Other Public Company Boards: 1

|

Tanya Beder currently serves as the Chair and CEO of SBCC Group, Inc. (“SBCC”), which she founded in 1987. SBCC is an independent advisory firm whose projects include assisting corporate management, institutional investors, large financial firms and other clients in solving complex financial problems under crisis and providing strategic advice to seize opportunities. Ms. Beder has served since 2011 on the board of the American Century mutual fund complex in Mountain View, CA, where she is Chair of the Board. She has served since 2019 as a member of the Kirby Corporation (NYSE: KEX) Board of Directors on the Audit and ESG and Nominating committees. Ms. Beder holds a Certificate in Cybersecurity Oversight from the Software Engineering Institute of Carnegie Mellon University.

Previously, Ms. Beder was the Chief Executive Officer of Tribeca Global Management LLC, a $2.6 billion dollar fund with operations in Singapore, London, and New York; Managing Director of Caxton Associates LLC, a $10 billion asset management firm; and President of Capital Market Risk Advisors, Inc. Ms. Beder also spent time in various positions with The First Boston Corporation (now Credit Suisse) where she was a part of the first team of derivatives traders and structurers for currency and interest rate swaps, caps, collars, floors, futures, and options, and was on the mergers and acquisitions team in New York and London. In January 2013, she was appointed to the President’s Circle of the National Academies after serving six years at the National Academy of Sciences on the Board of Mathematics and their Applications. Ms. Beder is a Board Member Emeritus of the International Association of Quantitative Finance, where she previously served as Chair. She is an appointed Fellow of the International Center for Finance at Yale University and taught courses on finance and fintech at Stanford University.

Ms. Beder holds a B.A. in mathematics and philosophy from Yale University, and an MBA from Harvard Business School.

| | | | |

| | Qualifications: Ms. Beder brings to the Board extensive asset management experience, vast knowledge of operational and risk management, and experience serving on both public and private Boards of Directors. The Board also benefits greatly from Ms. Beder’s service on key Committees, including the Compensation Committee, which she Chairs, as well as her financial expertise.

| | |

| | | | | | | | |

2023 Proxy Statement | | |  | | | | 27 | |

| | | | |

| | Anthony R. Chase

Independent Director

Director since: 2019

Age: 68

| | Committees: Compensation, ESG, Risk Oversight (C)

Other Public Company Boards: 3

|

Tony Chase is Chairman & CEO of ChaseSource, LP, a staffing, facilities management, and real estate development firm. ChaseSource is recognized as one of the nation’s largest minority-owned businesses by Black Enterprise Magazine. Mr. Chase started and sold three ventures (Chase Radio Partners, Cricket Wireless and ChaseCom) and now owns and operates his fourth, ChaseSource. The first, Chase Radio Partners, founded in 1992, owned seven radio stations and was sold to Clear Channel Communications in 1998. The second was Cricket Wireless a nationwide cell phone service provider that he started together with Qualcomm in 1993. Mr. Chase opened the first Cricket markets in Chattanooga and Nashville, TN. The third was ChaseCom, a company that built and operated call centers in the United States and India, which Mr. Chase sold to AT&T Corporation in 2007. He is also a principal owner of the Marriott Hotel at George Bush Intercontinental Airport in Houston and the Principle Auto Toyota dealership in greater Memphis, Tennessee.

Mr. Chase serves on the boards of LyondellBasell Industries N.V. (NYSE: LYB), CullenFrost Bank (NYSE: CFR) and Par-Pacific Holdings, Inc. (NYSE: PARR) and previously served on the Board of Heritage Crystal Clean, Inc. until 2022. Mr. Chase is Professor of Law Emeritus at the University of Houston Law Center. Mr. Chase is passionate about community engagement and chairs the City of Houston/Harris County COVID-19 Relief Fund and co-chaired the City of Houston/Harris County Hurricane Harvey Relief Fund.

Mr. Chase serves on several non-profit boards in Houston: Houston Endowment, Greater Houston Partnership, Texas Medical Center, MD Anderson Board of Visitors, and the Greater Houston Community Foundation. Mr. Chase served as Deputy Chairman of the Federal Reserve Bank of Dallas and the Chairman of the Greater Houston Partnership. He is also a member of the Council on Foreign Relations.

A native Houstonian, Mr. Chase grew up attending Houston public schools. He is an honors graduate of Harvard College, Harvard Law School and Harvard Business School. He is also an Eagle Scout. Mr. Chase is the recipient of many awards, including the American Jewish Committee’s 2016 Human Relations Award, Houston Technology Center’s 2015 Entrepreneur of the Year, 2013 Mickey Leland Humanitarian Award (NAACP), 2013 Bob Onstead Leadership Award (GHP) and the 2012 Whitney M. Young Jr. Service Award. He also received Ernst & Young’s Entrepreneur of the Year, the Pinnacle Award (Bank of America) and the Baker Faculty Award (UH Law Center).

| | | | |

| | Qualifications: Mr. Chase brings experience and expertise in oil and gas, risk oversight, environmental law, real estate, and management and provision of human resources. He also brings experience as an executive and as a board member of both public and private companies.

| | |

| | | | |

| | James R. Crane

Independent Director

Director since: 2012

Age: 69

| | Committees: Executive, Technology and Safety (C)

Other Public Company Boards: 0

|

Jim Crane is the Chair and CEO of Crane Capital Group Inc., an investment management company, a position he has held since 2006. Crane Capital Group has invested in transportation, power distribution, real estate and asset management. Its holdings include Crane Worldwide Logistics, a premier global provider of customized transportation and logistics services with 105 offices in 30 countries, and Crane Freight & Cartage. In addition, in 2011 Mr. Crane led an investor group that purchased the Houston Astros.

Mr. Crane was Founder, Chair and Chief Executive Officer of Eagle Global Logistics, Inc., a NASDAQ listed global transportation, supply chain management and information services company, from 1984 until its sale in August 2007. He also previously served onabove proposal, the Board of Directors may adjourn the relevant Meeting to a later date, or dates, if necessary, to permit further solicitation of Cargojet, Inc. (TO: CJT) and Western Gas Holdings, LLC.

| | | | |

28 | |  | | 2023 Proxy Statement |

proxies.THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE

ADJOURNMENT PROPOSAL.

Mr. Crane serves as the Chair of the Board of the Houston Astros Foundation as well as the Houston Astros Golf Foundation. He holds a B.S. in Industrial Safety from Central Missouri State University.

| | | | |

| | Qualifications: Mr. Crane’s experience in marketing, logistics, global operations, as well as his track record of creating shareholder value makes him an important resource to the Board. The Board also benefits from Mr. Crane’s proven leadership abilities and experience.

| | |

| | | | |

| | John P. Kotts

Independent Director

Director since: 2013

Age: 72

| | Committees: Audit (C), Compensation

Other Public Company Boards: 0

|

John Kotts is a private investor and entrepreneur. Through his management company, J.P. Kotts & Co., Inc., Mr. Kotts operates a private investment fund focused on the trading of U.S. and international securities and other financial instruments. He also invests in real estate and private equities. Mr. Kotts is currently the owner and CEO of Vesco/Cardinal, an oil tool rental and service company, as well as several manufacturing companies. Mr. Kotts is a member of the Board of Directors of Gulf Capital Bank. Mr. Kotts previously held various financial, banking and investment banking positions in companies specializing in leveraged buyouts, venture capital and turnaround transactions. From 1990 to 1998, he owned and operated Cardinal Services, Inc., a leading supplier of liftboat rentals and other production-related services, including mechanical wireline services and plug and abandonment services, to oil companies operating in the Gulf of Mexico.

Mr. Kotts holds a B.A. in Philosophy and an M.B.A in Finance from Hofstra University and completed additional post-graduate work at McGill University in Montréal, New York University and Harvard Business School.

| | | | |

| | Qualifications: Mr. Kotts’ industry background and knowledge, business acumen and financial expertise were the primary factors considered by the Board in deciding to appoint him as a director and nominate him for election to the Board. Mr. Kotts brings entrepreneurial drive and management skills to the Board.

| | |

| | | | |

| | Michael C. Linn

Independent Director

Director since: 2012

Age: 71

| | Committees: ESG (C), Risk Oversight

Other Public Company Boards: 1

|

Michael Linn is the President and CEO of MCL Ventures, LLC, an oil, gas and real estate investment firm. He is the former Chair, CEO, President and Director of LINN Energy, LLC, which he founded in 2003. Mr. Linn is a member of the Board of Directors of the general partner of Black Stone Minerals, L.P. (NYSE: BSM), and a member of the Board of Directors of CRP XII (Caliber Resource Partners). He also serves as a Senior Advisor to the Board of Directors of Quantum Energy Partners, LLC.

He was formerly on the Board of Directors and member of the Compensation Committee and Audit Committee for Jagged Peak Energy Inc.; Board of Managers for Wireline Holding Company, LLC; Board of Managers for Cavallo Mineral Partners, LLC; Board of Directors and Chair of the Conflicts Committee for Western Refining Logistics GP, LLC; and a Non-Executive Director and Chair of the SHESEC Committee which established safety rules and regulations for Centrica plc.

Mr. Linn is currently a member of the National Petroleum Council, and a former member of the Board of Directors and Chairman of the Independent Petroleum Association of America (IPAA). He also served as Chair and Director of the Natural Gas Council, as a Director of the Natural Gas Supply Association, as Chair and President of each of the Independent Oil and Gas Associations of New York, Pennsylvania and West Virginia, and as Texas Representative for the Legal and Regulatory Affairs Committee of the Interstate Oil and Gas Compact Commission.

| | | | | | | | |

2023 Proxy Statement | | |  | | | | 29 | |

11

Mr. Linn serves as Chair of the Board of Trustees of Texas Children’s Hospital and is a member of the Board of Visitors and Development Committee at M.D. Anderson Cancer Center. He is a member of the Senior Cabinet of the President’s Leadership Council at Houston Methodist Hospital and was formerly on the Board of Trustees, Long Range Planning Committee, and Finance Committee at the Museum of Fine Arts, Houston.

Mr. Linn holds a B.A. in Political Science from Villanova University and a J.D. from the University of Baltimore School of Law.

| | | | |

| | Qualifications: Mr. Linn’s broad understanding of the energy landscape and insight into the needs of our customers, together with his extensive industry knowledge and relationships, provide valuable resources to the Board. The Board also benefits from Mr. Linn’s proven leadership experience as a chief executive officer.

| | |

| | | | |

| | Anthony G. Petrello

Non-Independent Director

Director since: 1991

Age: 68

| | Committees: Executive (C)

Other Public Company Boards: 1

|

Tony Petrello has served as the Chairman of the Board of Nabors since 2012, and as a director since 1991. From 2003 to 2012, he served as the Deputy Chairman of the Board. Since 2011, Mr. Petrello has also served as President and CEO of Nabors, and was President and Chief Operating Officer from 1991-2011. Mr. Petrello also serves as a director of Hilcorp Energy Company and as an officer and director of Nabors Energy Transition Corp. (NYSE: NETC), a special purpose acquisition company co-sponsored by Nabors which completed its initial public offering in November of 2021. He is also a member of the Board of Trustees of Texas Children’s Hospital and an advocate for research and clinical programs to address the needs of children with neurological disorders.

In 2018, Mr. Petrello was the recipient of the Offshore Energy Center Pinnacle Award, which recognizes leaders for advancing technologies that have significantly enhanced the oil and gas industry. Prior to this, in 2011, Mr. Petrello and his wife, Cynthia, received the Woodrow Wilson Award for Public Service from the Smithsonian Institution for their philanthropic efforts.

Mr. Petrello holds a J.D. degree from Harvard Law School and B.S. and M.S. degrees in Mathematics from Yale University.

| | | | |

| | Qualifications: Mr. Petrello brings to the Board an extensive and unique combination of commercial, operational, technical, and innovation skills. These skills, plus his thorough knowledge of the Company’s operational activities worldwide, serve as an integral link between the Company and the Board, enabling the Board to better perform its oversight role. | | |

| | | | |

| | John Yearwood

Independent Lead Director

Director since: 2010

Age: 63

| | Committees: Audit, ESG, Executive, Risk Oversight, Technology and Safety

Other Public Company Boards: 2

|

John Yearwood currently serves on the Boards of Directors of TechnipFMC plc (NYSE: FTI) and Nabors Energy Transition Corp. (NYSE: NETC), a special purpose acquisition company co-sponsored by Nabors which completed its initial public offering in November of 2021. He also serves on the Boards of Directors of Sheridan Production Partners III, Foro Energy LLC, and Coil Tubing Partners LLC.

He previously served on the boards of Sabine Oil & Gas, LLC until August 2016, Premium Oilfield Services, LLC until April 2017, Dixie Electric LLC until November 2018, and Barra Energia LLC until December 2020. Until August 2010, he served as the Chief Executive Officer, President and Chief

| | | | |

30 | |  | | 2023 Proxy Statement |

TABLE OF CONTENTS

| | | | ARTICLE VIII

Miscellaneous |

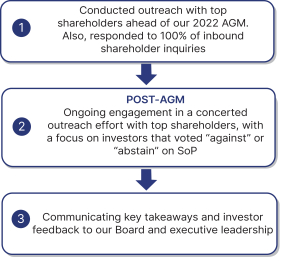

What We Heard

Regarding

Compensation

| | | | Actions Taken in Response

| | | | Outcome

|

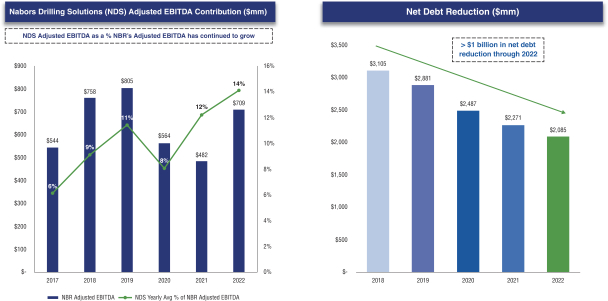

| | | | Performance goals under the PSUs are milestones established to drive long-term objectives. For example, our technology-based Drilling Solutions business continues to grow as a share of our business (See “Driving Long-Term Performance Through Our Long-Term Incentive Program”, bar graph below)

A multi-year, long-term performance award is being introduced in 2023, as part of the long-term incentive program, which will vest based on the achievement of an ROIC goal measured over a three-year performance period (2023-2025) (See “Adoption of New Multi-Year Performance Goal” below)

| | | | ✓ Implementing a new multi-year award that is subject to vesting based on performance measured over three years

|

| | | | | | |

| | | | | | | | |

| | | | | | |

Provide greater transparency into target setting process, including greater disclosure on compensation metrics used | | | | Compensation Committee continues to follow its three core values to guide its process to further evolve the program (See “Key Components of Our Compensation Approach” below)

We have enhanced our disclosure to explain how each of the performance goal metrics are unique and support our long-term strategies, such as the continued growth of our Drilling Solutions business (See table below where you can find these expanded disclosures in this proxy statement)

| | | | ✓ Enhanced rationale surrounding compensation program and all-around transparency (See “Executive Pay is Highly Performance-Based” section, below)

|

| | | | | | |

| | | | | | | | |

| | | | | | |

Consider using more than one metric for short term incentive

plan | | | | For 2022, we implemented an additional metric for the short-term incentive program by incorporating CAPEX as an additional financial metric to help drive performance of adjusted EDITDA towards prioritizing expenditures towards higher margin business segments (See “Assessment of 2022 Annual Cash Incentive Award Achievement” section, below) | | | | ✓ Short term incentive payout is determined based upon two financial metrics – Adjusted EDITDA and CAPEX

|

| | | | | | |

EXHIBIT A Form of Warrant | | | |

| | | | | | | | |

Improve benchmark compensation and performance peer groupsEXHIBIT B Protocol for Exercise of Warrants with Payment in Designated Notes | | | | As previously disclosed in the 2021 Proxy Statement, the Compensation Committee expanded the peer group from nine to fourteen companies to better reflect our business mix, international scale, and competitors for talent in order to assess the company’s relative performance and for our compensation benchmarking (See “Our Benchmark Compensation Peer Group” section below)

We frequently evaluate our peers to confirm that the peer group, used for both compensation and performance benchmarking, continues to be appropriate given the company’s energy transition strategy

| | | | ✓ Expanded peer group from nine to fourteen companies for 2022 and continue to assess new and existing peers given the energy transition industry environment

|

| | | | |

| | | | | | | | |

| | | | |

Ensure LTI compensation opportunity payout is at least proportional to relative TSR performance | | | | Together, with the Compensation Committee’s independent compensation consultant, we reviewed the TSR award payout structure against the peer group (See “Role of the Independent Compensation Consultant” section below)

Consistent with the Compensation Committee’s philosophy on further driving long-term, performance-based compensation, we determined it was appropriate to increase the rigor necessary to achieve proportionate TSR performance

| | | | ✓ Additional disclosure regarding TSR performance is included below

✓ As disclosed below we adopted a percentile based payout structure replacing the ranking based structure

|

| | | | |

| | | | | | | | |

| | | | |

40 | |  | | 2023 Proxy Statement |

| | | | | | | | |

| | | | |

What We Heard

Regarding

Compensation

| | | | Actions Taken in Response

| | | | Outcome

|

| | | | |

Enhance disclosure of compensation component benchmarking | | | | Compensation Committee consistently reviews the individual componentsA-ii

TABLE OF CONTENTS AMENDED AND RESTATED WARRANT AGREEMENT, dated as well as the total direct compensation (sum of base salary + annual bonus + long term incentives) (“TDC”) for the CEO and CFO vs. our peer group | | | | ✓ Additional disclosure regarding this review is included below

|

| | | | |

| | | | | | | | |

| | | | |

Adopt an enhanced clawback policy | | | | We reviewed our existing policies and regulatory requirements | | | | ✓ We intend to adopt a clawback policy consistent with listing standards and timings required by the NYSE and SEC and expect to adopt such policy by the end of 2023

|

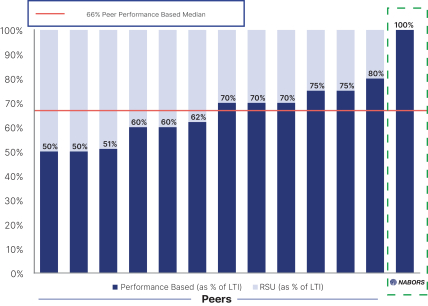

Key Components of Our Compensation Approach

The above section details key feedbackJune 10[ ], 20212024 (this “Agreement”), between Nabors Industries Ltd., a Bermuda exempted company (the “Company”), Computershare Inc., a Delaware corporation, and actions taken based on our engagement with shareholders overits wholly-owned subsidiary,affiliate, Computershare Trust Company, N.A., a federally chartered trust company, collectively as Warrant Agent (the “Warrant Agent”) (each a “Party” and collectively, the past year. Based on our conversations with shareholders, there are several key components “Parties”) amending and restating that certain Warrant Agreement dated as of Nabors’ executive compensation approach that makeJune 10, 2021 among the Company distinct from its peers and the broader market. These key components are united by four overarching considerations:

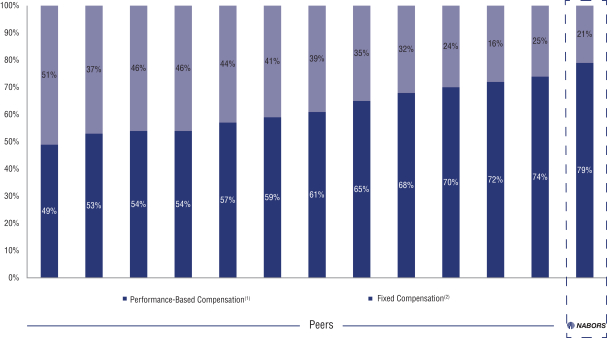

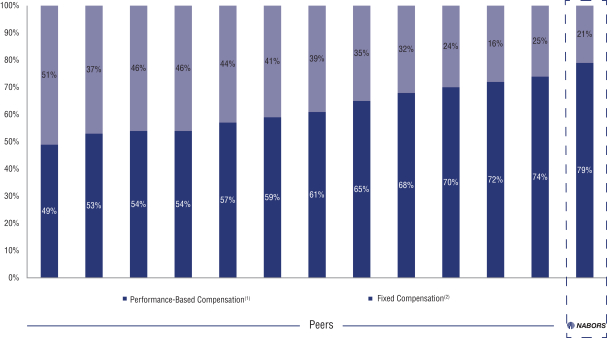

| 1. | The Compensation Committee’s commitment to maintain our demonstrated lowest percentage of fixed annual pay for the CEO and highest performance pay component relative to our peer group (See Figure 5, below).

|

| 2. | The Compensation Committee’s rigorous and unique approach to setting incentive compensation, including the use of well-defined, measurable metrics.

|

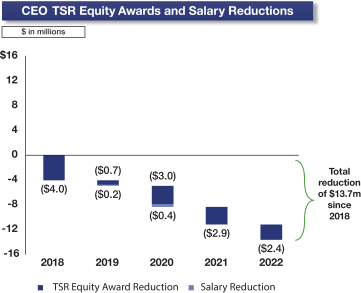

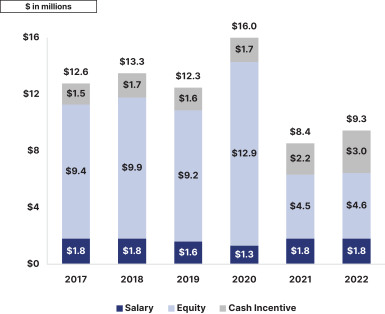

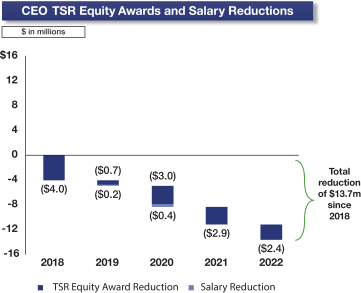

| 3. | The serious efforts made to right-size and adjust Nabors’ executive compensation program in line with shareholder feedback and to emphasize performance and long-term value, driving a total of $13.7 million in CEO compensation opportunity reductions since 2018 (See Figure 8, below).

|

| 4. | Nabors’ business model and our unique positioning with regards to responsible fossil fuel activity, technology development and the energy transition.

|

These distinct features stood out in our conversations with shareholders and are detailed at greater length below.

How We Set Base Salary and Total Compensation Levels

Warrant Agent (the “Original Agreement”).

The

Compensation Committee strives to set base salary and performance-based compensation for our CEO and CFO in relationBoard of Directors has declared a distribution (the “Warrant Distribution”) to the

desired total mixholders of

fixed vs. at-risk pay.Base salary is established by contractual obligations with our CEO, and in acknowledgement of Nabors’ complex, multi-business unit, global organizational structure. Companies similar in size to Nabors, based on measures of revenue and market capitalization, typically do not operate at a global scale. Nabors’ performance-based compensation is established according to Nabors’ global complexity and a substantial focus on technology-based, higher margin businesses, which now account for 16% of overall EBITDA, up from 3%, five years ago. The Compensation Committee thus sets base salary accordingly. Compared to its peers, Nabors’ CEO has the lowest percentage of total annual compensation opportunity that is non-performance based (with non-performance based compensation consisting of salary plus time-vested, non-performance-based RSUs).

This approach aligns total CEO compensation with the long-term interests of shareholders, balancing salary with 100% at-risk stock-based performance-based compensation and competitive total compensation within the peer group. For further discussion of our incentive compensation program, (see “Our Distinct Approach to Performance-Based Compensation”).

| | | | | | | | |

2023 Proxy Statement | | |  | | | | 41 | |

Driving Long-Term Performance through Our Long-Term Performance-Based Incentive Program

In our discussions with shareholders, the topic of long-term performance-based compensation was often discussed, including the one-year performance period for Nabors’ PSU program. We responded to shareholders questions surrounding the structurerecord of the programCompany’s common shares, par value $0.05 per share (the “Common Shares”), as of 5:00 P.M., New York City time, on June 4, 2021 (such date and its alignment with long-term strategy.

Intime, the view of the Compensation Committee, Nabors’ LTI program drives long-term objectives and significantly aligns our NEOs with shareholders. CEO, CFO and, commencing in 2023, Corporate Secretary compensation is tied to relative three-year TSR performance, and the other component of our LTI program ties PSU payouts to performance goals measured on an annual basis.

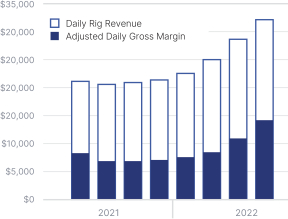

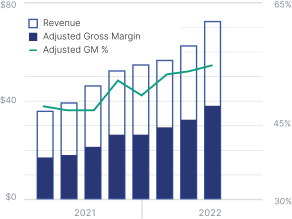

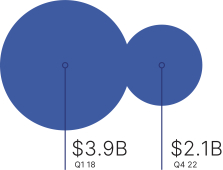

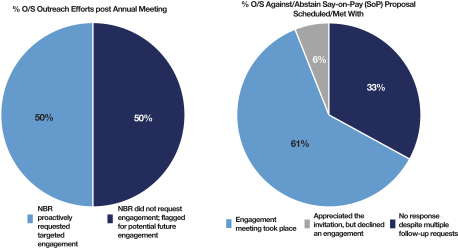

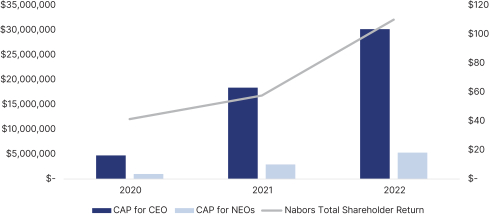

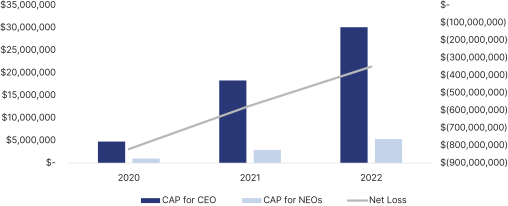

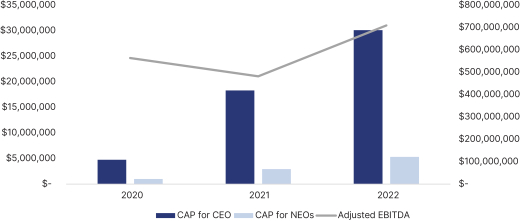

The two figures below demonstrate how Nabors’ LTI incentive components have driven the long-term execution of our strategy. LTI metrics related to our balance sheet have led to consistent deleveraging to ensure Nabors is positioned to pursue a growth-oriented capital allocation approach (See Figure 3“Distribution Record Date”), while metrics related to the development of our innovative NDS offering have led to a discernible upward trend over the last several years in the segment as a component of our Adjusted EBITDA (See Figure 2). For 2022, NDS Adjusted EBITDA increased to $98.7 million, an impressive 66% improvement over 2021 and which represented 14% of Nabors’ overall Adjusted EBITDA of $709 million. The Adjusted EBITDA contribution from NDS increased by nearly two percent versus the prior year, even with the backdrop of very strong growth in Adjusted EBITDA in the balance of Nabors’ portfolio.

Figure 2 Overview of Long-Term Performance Achievements Figure 3 Overview of Long-Term Performance Achievements

Adoption of New Multi-Year Performance Goal

In 2023, the Compensation Committee will introduce a new multi-year long-term incentive program for the CEO and certain other key officers of the Company. This new program was adopted in response to shareholder feedback seeking multi-year performance measurement periods and goals.

In developing the program, the Compensation Committee studied practices among peers and analyzed several potential metrics for the new program, including their historical correlation to shareholder returns. As a result of this effort, the Compensation Committee selected ROIC as the metric for the new program. Under the new program, ROIC performance will be measured over a three-year period (2023-2025). Average ROIC performance over this period will be assessed against pre-established goals.

| | | | |

42 | |  | | 2023 Proxy Statement |

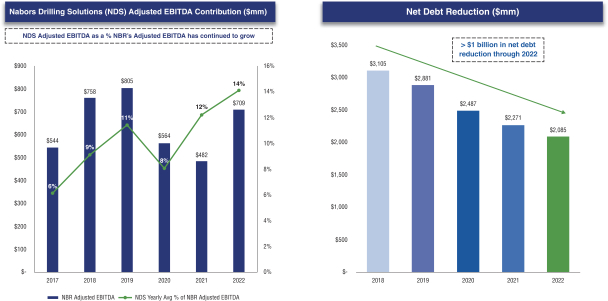

Our Distinct Approach to Performance-Based Compensation

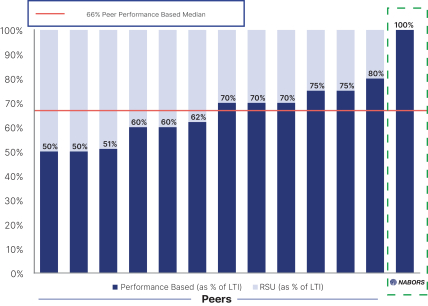

Nabors is unique among its peers in not awarding any CEO or CFO compensation in the form of time-vested equity awards. 100%warrants to purchase Common Shares. The Company desires to issueissued the warrants on the terms and conditions described in the Original Agreement, as amended herein (the “Warrants”) in satisfaction of Nabors’ LTI compensation is performance-based, vs. a median of only 66% being performance-based for our peer group. Figure 4 below shows a breakout of compensation components for Nabors and its peers.

Figure 4 Breakout of Nabors Compensation Components

Nabors Has a Greater Percentage of Compensation Tied to Performance

The below chart serves to underscore the degree to which Nabors’ executive compensation is performance-based in comparison to our peers. Please referWarrant Distribution. Pursuant to the “Our Benchmark Compensation Peer Group” section below to learn moreabout our compensation philosophy and benchmarking process.

Figure 5 Nabors CEO Performance-Based Compensation vs. Peers

| | | | | | | | |

2023 Proxy Statement | | |  | | | | 43 | |

(1) | Performance-Based Compensation includes STIs + PSUs + relative TSRs. The above graph reflects CEO compensation for 2021 as disclosed by companies. Sources are public filings and publicly available trading data. Compensation peer group excludes Valaris and Noble Corporation because of lack of comparable information for the considered period.

|

(2) | Fixed compensation includes salary and RSUs.

|

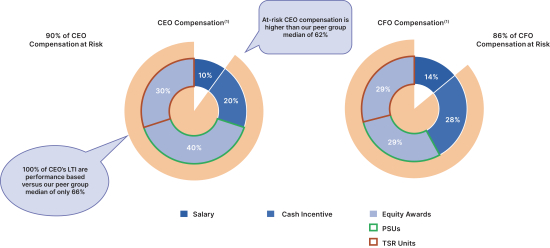

Executive Pay is Highly Performance Based

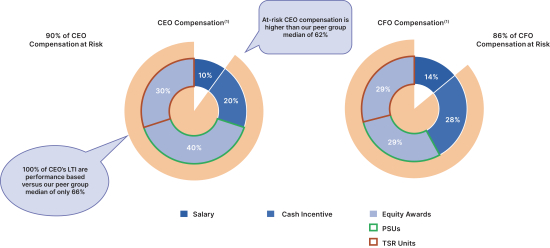

We believe a differentiating featureWarrant Distribution, each holder of Nabors’ executive incentive compensation, is making it highly performance based. The Compensation Committee remains committed to maintaining CEO and CFO equity-based compensation 100% performance-based, without the usage of time-vesting RSUs (See Figure 6, below).

Figure 6 Nabors At Risk Compensation Overview

(1) | Assumes payout at maximum contractual entitlement, and excludes Change in Pension Value, Nonqualified Deferred Compensation Earnings, and All Other Compensation, as such categories would be reflected in the Proxy Statement’s Summary Compensation Table.

|

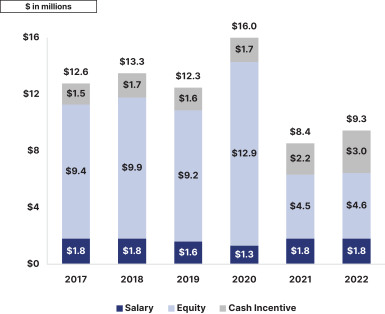

Right-Sizing Our C-Suite Compensation

Nabors remains committed to right-sized CEO compensation and, in 2022, we continued our ongoing efforts to deepen our program alignment with long-term shareholder value. The below table shows how the summary structure of our CEO compensation program has evolved over the past six years, leading to a significant reduction in the quantum of CEO pay opportunities:

Figure 7 CEO Compensation Over Time

| | | | |

44 | |  | | 2023 Proxy Statement |

In our conversations with shareholders, we received positive feedback and encouragement for the measures taken to right-size executive compensation. In recent years, we restructured the equity awards program in direct response to shareholder feedback by taking the following steps:

• | | Capping the value of the CEO’s maximum payout under the TSR Shares at five times the grant date fair market value, irrespective of any increase in the value of the shares at the time the award is earned;

|

• | | Capping the number of TSR Shares that may vest at end of performance period at target if the Company’s TSR is negative;

|

• | | Negotiating overall reductions to contractually entitled TSR awards.

|

These efforts resulted in a meaningful reduction to total direct compensation. Taken a further step back, CEO TSR equity award opportunity and fixed base salary have been reduced by a total of $13.7 million since 2018 (See Figure 8, below).

Figure 8 Overview of CEO Compensation Reductions Over Time

Our Benchmark Compensation Peer Group

Compensation Peer Group Development Philosophy

In designing our executive compensation peer group, we adhere to the following philosophies and approaches:

| | |

| |

1

| | Business profiles that align closely with Nabors along services and market presence in one or more meaningful business lines |

| |

2

| | An analogous impact of market cycles and influences on supply and demand to help gauge both long- and short-term performance comparisons |

| |

3

| | Similar legal and regulatory pressures relating to the diversity of geographies served and scope of operations |

| |

4

| | Related human capital issues, including those related to attracting and retaining talent from a common pool of individuals |

| |

5

| | Consistency among the peer group members, including prioritizing those companies reasonably similar in terms of key metrics, which allows for better, more accurate long-term analysis |

| | | | | | | | |

2023 Proxy Statement | | |  | | | | 45 | |

Selection Process and Rationale

In advance of the 2022 performance year, we conducted a thorough review of our peer group to better reflect our business mix, international scale, and competitors for talent. In recent years, Nabors has expanded its offerings in technology and the energy transition, a fundamental shift in our business model and long-term strategy. Given this fundamental shift, the Compensation Committee determined that a new peer group better reflecting Nabors’ core long-term strategy was warranted. Following the review, we expanded our peer group from nine companies to fourteen and utilize the same peer group for both operational and compensation-related performance goals.

Figure 9 Nabors Peer Group Selection Process

The rationale behind conducting such benchmarking is to provide an outside-in point of reference with respect to quantum and structure of compensation practices. In that perspective, we believe Nabors is in a unique situation at the crossroads of the following criteria: size, business mix, industry and market focus, geographical presence, and addressable talent pool. We are confident that the time spent developing and expanding Nabors’ peer group in partnership with our independent, outside compensation consultant produced a peer group that takes into account Nabors’ unique positioning. The Compensation Committee reviews the peer group at least annually and more frequently, as necessary, taking into consideration macro events affecting the number of peers in our group and the potential growth impact our technology and energy transition businesses may have on future benchmarking. Following a review in 2022, the Compensation Committee reaffirmed that the current peer group remained appropriate for the 2023 performance period.

Market Capitalization and Size

Nabors operates in a market where its competitors are public and private players of various sizes. In many instances, the Company competes with both local and large global companies, which led our Compensation Committee to include companies of various sizes in our peer group in order to reflect the reality of the competition we face for attracting and retaining C-suite talent. Our peer group focuses on publicly traded companies trading on stock exchanges in the United States.

| | |

| |

This competition extends to our overall management ranks; 30% of our senior management were recruited from members of our peer group, of which 66% joined Nabors from either Baker Hughes, Halliburton, or SLB, the largest market cap members of our peer group (See Figure 10, below). | |  |

| | | | |

46 | |  | | 2023 Proxy Statement |

Mix of Revenue Lines

In recent years, Nabors has been building and expanding its NDS business, helping us deliver superior financial performance. At times, Nabors competes with companies operating in only one of our business segments. The development of our NDS business also led us to compare ourselves to similar businesses in terms of cash conversion profile, capital intensity and technology focus.

Our strategy has increasingly focused on expanding our development of proprietary technology and intellectual property through our NDS segment. These offerings yield higher margin than traditional oilfield services. For example, NDS gross margins in 2022 equaled 51% versus an average gross margin of 37% across all business segments for Nabors’ traditional drilling services. Further, NDS’ offerings require much lower CAPEX, and are characterized by a high degree of operating leverage.

In addition to our increasing focus on technology, Nabors has a multi-pronged approach to innovation and business line development as it relates to the energy transition. Nabors Energy Transition Solutions (NETS) encompasses a comprehensive and evolving suite of advanced and automated technologies that help our clients improve energy efficiency and reduce emissions. Nabors Energy Transition Ventures (NETV) makes venture-stage investments in companies innovating in the energy transition, utilizing Nabors’ extensive domain expertise and energy industry relationships to accelerate leading edge technologies such as geothermal, energy storage, hydrogen, and emissions monitoring. To date, we have partnered with four companies involved in geothermal energy production and technology, as well as in companies engaged in energy storage solutions such as sodium-ion batteries. The combination of NETS and NETV allows Nabors to maximize its impact for clients and stakeholders around the energy transition and forms another cornerstone of Nabors’ long-term strategy.

As a result of this evolution in our business mix, our peer group also comprises players we compete with taking into account all of our meaningful business lines.

Focus on Energy Transition and Technology

2022 was a year of major progress for Nabors in pivoting our business profile and investing in technology and services to support the energy transition. As a testimony to this commitment, we deployed four innovative energy transition products in the areas of hydrogen, geothermal, emissions monitoring and energy storage, and Nabors received the Energy Transition Award – Upstream at the 2022 Platts Global Energy Awards.

Nabors approach to diversification is unique relative to other companies of similar size and scale, which also led our Compensation Committee to expand our peer set towards larger competitors engaging in similar business transitions (See Figure 10, below, illustrating the overlap in technologies between Nabors and its expanded peer group).

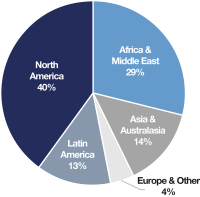

Geographic Scale

For its size, Nabors serves a diverse set of geographies, operating in 15 countries in total, providing drilling and drilling-related services for land-based and offshore oil and natural gas wells.

In that respect, Nabors operates a global business with complexity on the scale of that of the largest oil field services companies, which is another reason for inclusion of competitors of various size and geographical footprint in our executive compensation and operations peer group.

Talent Pool

Given the above, Nabors is in fierce competition for talent with the largest companies in the energy industry, including for C-suite and other leadership positions (See Figure 10, below, highlighting how we compete for talent against our peers). Generally, our operations require highly qualified human capital and proactive management of talent flow, the scarcity of which increases competition among industry players regardless of their size or location.

| | | | | | | | |

2023 Proxy Statement | | |  | | | | 47 | |

Our peer group reflects that competition and the need for talent to drive Nabors’ initiatives. The table below highlights a few key points of comparison with our peer set:

Figure 10 Nabors Peer Group Comparison

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Company | | Ticker | | | Market Capitalization(1) | | | Enterprise

Value(1) | | | Revenue(2) | | | Employees(1) | | Countries of

Operation(1) | | GICS | | Similar

Technology? | | Nabors

FTEs

previously

employed

by Peer |

| | | | | | | | | |

Valaris | | | VAL | | | $ | 5,084 | | | $ | 4,998 | | | $ | 1,398 | | | 5,450 | | Undisclosed | | Oil and Gas Drilling | | ✓ | | ✓ |

| | | | | | | | | |

NOV | | | NOV | | | $ | 8,206 | | | $ | 9,631 | | | $ | 7,237 | | | 32,307 | | 62 | | Energy Equipment & Services | | ✓ | | ✓ |

| | | | | | | | | |

Schlumberger | | | SLB | | | $ | 75,806 | | | $ | 85,977 | | | $ | 28,178 | | | 99,000 | | >100 | | Energy Equipment & Services | | ✓ | | ✓ |

| | | | | | | | | |

Halliburton | | | HAL | | | $ | 35,732 | | | $ | 42,495 | | | $ | 20,297 | | | 45,000 | | >70 | | Energy Equipment & Services | | ✓ | | ✓ |

| | | | | | | | | |

Precision Drilling Corp. | | | PDS | | | $ | 1,035 | | | $ | 1,960 | | | $ | 1,242 | | | 4,802 | | 6 | | Oil and Gas Drilling | | ✓ | | |

| | | | | | | | | |

TechnipFMC | | | FTI | | | $ | 5,442 | | | $ | 6,996 | | | $ | 6,199 | | | 23,346 | | 41 | | Oil and Gas Equipment & Services | | ✓ | | |

| | | | | | | | | |

Weatherford International | | | WFRD | | | $ | 3,595 | | | $ | 5,031 | | | $ | 4,331 | | | 17,700 | | ~75 | | Oil and Gas Equipment & Services | | ✓ | | ✓ |

| | | | | | | | | |

Patterson-UTI Energy | | | PTEN | | | $ | 3,651 | | | $ | 4,433 | | | $ | 2,648 | | | 6,500 | | 2 | | Energy Equipment & Services | | ✓ | | ✓ |

| | | | | | | | | |

Expro Group | | | XPRO | | | $ | 1,972 | | | $ | 1,909 | | | $ | 1,437 | | | 7,600 | | ~60 | | Oil and Gas Equipment & Services | | ✓ | | |

| | | | | | | | | |

Flowserve Corp. | | | FLS | | | $ | 4,010 | | | $ | 5,150 | | | $ | 3,496 | | | 16,000 | | >50 | | Machinery | | | | |

| | | | | | | | | |

Helmerich & Payne | | | HP | | | $ | 5,224 | | | $ | 5,397 | | | $ | 2,369 | | | 7,000 | | >5 | | Energy Equipment & Services | | ✓ | | ✓ |

| | | | | | | | | |

Baker Hughes | | | BKR | | | $ | 29,573 | | | $ | 32,885 | | | $ | 21,156 | | | 55,000 | | >120 | | Energy Equipment & Services | | ✓ | | ✓ |

| | | | | | | | | |

Noble Corp. | | | NE | | | $ | 5,094 | | | $ | 2,660 | | | $ | 999 | | | 5,800 | | >23 | | Oil and Gas Drilling | | ✓ | | ✓ |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | NBR | | | $ | 1,458 | | | $ | 4,466 | | | $ | 2,654 | | | 12,000 | | 15 | | Energy Equipment & Services | | | | |

| | | | | | | | | |

Median | | | | | | $ | 5,094 | | | $ | 5,150 | | | $ | 3,496 | | | 16,000 | | | | | | | | |

(2) | Based on publicly available information.

|

Continuing To Refine Our Program

In response to robust shareholder discussions and feedback, Nabors continues to evaluate changes to its compensation program in order to ensure alignment with compensation and shareholder objectives. In particular, the following are refinements that have been implemented or are currently under consideration:

• | | We intend to adopt an enhanced clawback policy that is consistent with the listing standards required by the NYSE and SEC.

|

• | | We intend to keep 100% of our LTI share-based compensation tied to performance-based metrics for our CEO and CFO.

|

• | | A multi-year, long term performance stock unit award is being introduced in 2023, as part of the long-term incentive program, which will vest based on the achievement of an ROIC goal measured over a three-year performance period (2023-2025).

|

• | | We continue to enhance disclosure around how our performance goal metrics are well-defined, measurable and support the long-term strategy of creating value for our shareholders. Please refer to the section titled “2022 Compensation Results Summary” for further disclosure on performance goal metrics and the Compensation Committee’s process.

|

| | | | |

48 | |  | | 2023 Proxy Statement |

• | | Commencing in 2023 for the TSR Share award, we modified payout metrics to a percentile-based rather than rankings-based structure to achieve TSR Share payouts that are more proportionate to level of TSR achievement.

|

Compensation Dos and Don’ts

In 2022, we continued to adhere to compensation practices that strengthen the alignment between the compensation of our executive officers, Company performance and shareholder returns:

| | |

| |

What We Do

| | What We Don’t Do

|

| |

Compensation philosophy aligns pay with financial and operational performance, including a mix of relative and absolute metrics; a significant portion of executive pay is performance-based or “at risk”

| | No buyout or exchange of underwater options, or repricing of underwater stock options without shareholder approval

|

| |

Share ownership policyaligns executive officer interests with those of shareholders

| | No excise tax gross-ups in connection with a change-of-control

|

| |

Cap total shareholder return (“TSR”) Share award payouts

| | No guaranteed bonuses

|

| |

Cap severance payments in our executive agreements

| | Target individual elements of compensation or total compensation to a certain percentile within a peer group

|

| |

Hold an annual Say-on-Pay vote

| | No automatic share replenishment or “evergreen” provisions in our stock incentive plans

|

| |

Shareholder engagement program in place with track record of making positive changes in response to shareholder feedback

| | No excessive perquisites without a compelling business rationale

|

| |

Conduct market referencing of peer group companies, compensation surveys and market data to understand how our aggregate executive compensation compares to competitive norms

| | No time-based equity awards are granted to our CEO or CFO, rather 100% is performance based

|

| |

Maintain an independent Compensation Committee

| | No uncapped incentives

|

| |

Work with an independent compensation consultant

| | No tax gross-ups in any future executive officer agreements

|

Detailed Compensation Overview: What We Pay and Why We Pay It

Setting Executive Compensation

Our Compensation Committee, independent consultant and other resources each play an important role in determining our executive compensation structure.

Role of the Compensation Committee

The Compensation Committee, which consists of three independent non-employee Directors, performs the following compensation-related functions:

• | | Oversees the compensation of our senior leadership team;

|

• | | Establishes, reviews and approves measurable goals applicable to the compensation of the CEO and CFO and the goals and objectives of the Company’s executive compensation programs;

|

• | | Evaluates the performance of our CEO and reviews the performance of our senior leadership team members, drawing on its own judgement and observations and those of our CEO in evaluating the performance of such officers;

|

| | | | | | | | |

2023 Proxy Statement | | |  | | | | 49 | |

• | | Administers our equity-based programs for senior leadership team members, and reviews and approves all forms of compensation (including equity grants);

|

• | | Approves financial and business measures and goals that are tied to the Company’s performance for long-term equity incentive awards;

|

• | | Oversees employment agreements between the Company and the executive officers;

|

• | | Considers input from the Risk Oversight, Audit, ESG and Technology & Safety Committees with respect to risk adjusted return and stakeholder considerations in evaluating performance objectives and incentives; and

|

• | | Recommends to the Board the compensation program for the Board of Directors.

|

The Compensation Committee has discretion to decrease formula-driven awards or provide additional incentive compensation based on executive retention considerations. It also has discretion to provide additional incentive compensation (i.e., special bonuses) in recognition of extraordinary specific developments that materially enhance the value of the Company. For further information about compensation of non-executives, see “Equity-Based Award Policy” below for a brief discussion of authority delegated to the CEO with respect to employee equity grants.

Role of the Independent Compensation Consultant

The Compensation Committee has the sole authority to retain, obtain the advice of, and terminate, any compensation consultant, independent legal counsel, or other advisors to assist the Compensation Committee in the discharge of its duties and responsibilities, including the evaluation of director and executive compensation. In the discharge of its duties, the Compensation Committee relies on an independent consultant to:

• | | Provide information and analysis on executive compensation trends and market developments;

|

• | | Advise on potential peer group members to evaluate our CEO’s CFO’s and Corporate Secretary’s compensation;

|

• | | Review and analyze peer group information to assist with setting of executive compensation;

|

• | | Review and analyze peer group information to assist with setting of independent Directors’ compensation;

|

• | | Update the Compensation Committee periodically on legislative and regulatory developments impacting executive compensation; and

|

• | | Provide additional assistance, as requested by the Compensation Committee.

|

Following the 2021 AGM, as part of its refreshment program the Compensation Committee engaged Pay Governance as its independent consultantto advise and assist the Committee with benchmarking the executive compensation program. The Compensation Committee evaluated Pay Governance’s independence during 2022 by considering a number of factors, including the six factors identified by the NYSE and the SEC independence guidelines.

Based on these evaluations, the Compensation Committee concluded there were no independence or conflict-of-interest concerns related to Pay Governance’s engagement.

Role of Management

Certain of our executive officers and senior management provide input on business strategy and short- and long-term business objectives, which assists the Compensation Committee in establishing performance goals in connection with long-term components of our executive compensation program. In addition, the Compensation Committee consults with the CEO in setting the compensation of other executive officers and senior management upon their hiring with the Company and periodically thereafter as deemed appropriate by the Compensation Committee. The CEO also provides a subjective performance assessment of other executive officers and senior management, which is reviewed and considered by the Compensation Committee in determining each individual’s performance and resulting compensation.

How We Determine Base Salary (Fixed Compensation)

Base salary is the single fixed element in our executives’ annual cash compensation. The Compensation Committee periodically reviews and makes its determination, taking into account various factors, including the Company’s performance, the executive’s experience in business and the industry, industry conditions, and shareholder feedback.

| | | | |

50 | |  | | 2023 Proxy Statement |

CEO Base Salary

Our CEO’s base salary did not increase in 2022. CEO base salary is set as a result of contractual obligations with our CEO, and reflects Nabors’ complex, global organizational structure. Companies similar in size to Nabors, based on measures of revenue and market capitalization, typically do not operate at a global scale, but given the level of responsibility that comes with operating a global organization, the Compensation Committee believes our CEO’s base salary rate is appropriate.

Other NEO Base Salary

For our other NEOs, the Compensation Committee takes a similar approach to determining base salary levels. Like our CEO, base salary is the only compensation component for the CFO that is considered “fixed” compensation; all other compensation consists of performance based renumeration tied to corporate performance. Our Corporate Secretary’s annual base salary is established each year by our Compensation Committee after taking into account the factors described below.

The Compensation Committee may also take into account certain competitive factors, which sometimes include:

• | | Compensation levels of similarly situated executives of other drilling contractors, and in oilfield services or other relevant sectors at companies in our peer group;

|

• | | Necessary levels of compensation to attract and retain highly talented executives from outside the industry; and

|

• | | A newly hired executive’s salary at their most recent place of employment.

|

2022 Annual Base Salary

In 2022 the Compensation Committee initiated a review of the Company’s pay scale and provided meaningful increases to key personnel throughout the Company, including our Corporate Secretary and CFO, to ensure retention and competitiveness in the marketplace. As a result, our CEO’s base salary remained the same at $1.75 million and our CFO’s salary increased, the first such increase since joining the Company in 2014, to $750,000. The Corporate Secretary’s base salary was increased to $275,000. Further, based on a comprehensive market review and discussions with multiple third-party independent compensation consultants, base salaries for critical positions were benchmarked against industry peers. As a result, base salaries for these positions are now brought to market median.

It remains the Compensation Committee’s policy to minimize guaranteed payments to our NEOs, instead focusing on performance-based awards.

How We Determine Annual Cash Incentive

All of our CEO’s and CFO’s annual cash incentive awards are based on performance metrics. The annual cash incentive is targeted at 100% of the executives’ base salaries and capped at twice such amount. This cap of 2.0 times base salary is the lowest versus Nabors’ peers, which range from 2.02 to 3.10 times base salary. The metrics for earning the annual cash incentives are determined by the Compensation Committee at the beginning of the applicable performance year based on well-defined, measurable metrics. The Compensation Committee sets targets for achieving those goals:

• | | Minimum threshold before any annual cash incentive can be earned;

|

• | | Target award dollar amount to incentivize a specific desired performance level; and

|

• | | Maximum goal which sets an appropriate limit on the potential annual cash incentive that can be earned.

|

The performance measures are pushed down to the business units and functions to ensure all employees throughout the Company are focused on the same goals. At the end of the performance year, the Compensation Committee determines whether the performance goals have been attained and approves any cash payment amount based upon the level of achievement of the pre-established annual performance goals. If actual performance results fall between payout levels, straight-line interpolation is used to determine the award payout. Adjustments to targets are permitted as deemed appropriate by the Board to account for significant events that warrant an adjustment.

| | | | | | | | |

2023 Proxy Statement | | |  | | | | 51 | |

2022 Annual Cash Incentive Results

In 2022, the CEO earned a cash incentive bonus of $3 million, and the CFO earned a cash incentive bonus of $1.3 million, in each case based upon achievement of the Adjusted EBITDA less CAPEX levels shown in the chart below under “Annual Incentive Plan Goals”. The Corporate Secretary earned a cash incentive bonus of $150,700 based upon achievement of his Annual Incentive Plan Goals (as described further below).

How We Determine Long-Term Equity Incentives

Pursuant to their employment agreements, our CEO and CFO are eligible to earn equity awards that are performance based – TSR Shares and Performance Stock Units.

| | |

Key Features

| | • Cliff vesting based on the Company’s TSR performance relative to the peer group measured over a three-year period

• Minimum performance criteria must be met in order for any TSR Shares to vest

• Number of shares that may vest at end of performance period are capped at target if our TSR performance is negative

• Aligns executive incentives with share performance while avoiding excessive payouts

•New for 2023: In response to shareholder feedback, the payout metrics for TSR awards shall be earned on a relative percentile basis instead of a ranking class to ensure payout is fully aligned with performance

|

How We Determine Our Performance-Based TSR Shares

With respect to the TSR Shares, the target value – 150% of our CEO’s contractual base salary and 100% of our CFO’s contractual base salary – is awarded to our CEO and CFO, each of whom then has the opportunity to earn up to 200% of the number of target TSR Shares granted based on performance during the performance period.

The number of TSR shares that can be earned based on three-year TSR rank is shown in the table below. However, if the Company’s absolute TSR is negative, the maximum payout is capped at target. Additionally, beginning in 2021 the value of the CEO’s maximum payout is capped at five times the grant date fair market value, irrespective of any increase in the value of the shares at the time the award is earned. Any TSR Shares that are not earned at the end of the performance period are immediately forfeited.

In 2022, the Compensation Committee and the CEO again agreed to reduce his TSR Share award target grant date value to 50% of his total contractual target opportunity.

| | | | |

TSR Rank

| | | | Percentage of Maximum Shares Earned |

1, 2 or 3

| | | | 100% |

4 or 5

| | | | 75% |

6 or 7

| | | | 60% |

8 or 9

| | | | 50% |

10 or 11

| | | | 40% |

12 or 13

| | | | 25% |

14 or 15

| | | | 0% |

|

TSR: TSR for the common shares of Nabors and each Peer means the difference between (x) the average closing price for the 30 consecutive trading days prior to the start of the performance period, and (y) the average closing price for the last 30 consecutive trading days during such performance period, as adjusted for dividends paid during such performance cycle.

| | | | |

52 | |  | | 2023 Proxy Statement |

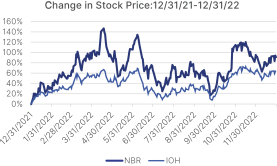

TSR Shares Earned (Granted in January 2020 and Earned over 3 Years Based on Total Shareholder Return Relative to Our Peers)

Based on the Company’s share performance for the 2020 – 2022 performance period, the Company’s ranking for TSR Shares granted in January 2020 was 7 out of 14 peers for that period and resulted in a multiplier of 110% being applied to the target grant of TSR Shares. Therefore, the CEO payout was 7,236 restricted shares, and the CFO’s payout was 5,376 restricted shares. The Corporate Secretary did not participate in the TSR Share Plan in 2020.

Commencing in 2023, the Compensation Committee, in response to shareholder feedback, modified the TSR payout opportunity to increase the rigor required to achieve threshold, target and maximum TSR Share entitlement to use a relative performance percentile basis. This record will replace the ranking payout schedule as depicted in the above 2022 TSR Grant table. The Compensation Committee believes the modified structure will ensure payout is fully aligned with performance and is consistent amongst our peer group.

Going forward, the new TSR Payout will be as follows:

| | | | |

|

2023 TSR Grant |

| | | | |

| | |

Award Payout Level | | TSR Relative to the Peer Group

at End of Performance Cycle | | Percentage of Maximum Shares

Earned |

| | |

Maximum

| | 85th Percentile or greater | | 100% |

| | |

Target

| | 50th Percentile | | 50% |

| | |

Threshold

| | 25th Percentile | | 25% |

| | |

No Payout

| | Below 25th Percentile | | 0% |

|

How We Determine the Level of Performance Stock Units Earned

We first introduced Performance Stock Units (PSUs) in 2020 in direct response to shareholder feedback. PSUs are earned on a pro-rated basis based on the number of goals (or overall percentage of all goals) achieved. For the 2022 performance cycle:

• | | Threshold performance required the achievement of at least one goal;

|

• | | Target performance required the achievement of the equivalent of 50% of all goals; and

|

• | | Maximum performance required achievement of all five goals for the CEO and all four goals for the CFO.

|

With respect to the Performance Stock Units, the target value 200% of our CEO’s contractual base salary and 100% of our CFO’s contractual base salary is awarded to our CEO and CFO, each of whom then has the opportunity to earn 200% of the number of target PSUs granted based on the level of achievement of the established performance goals. Although performance goals established for the PSUs are set and measured annually, each of the goals is designed to be part of the Company’s longer-term strategy and are related to long-term or multi-year goals set by the Company. Further, the PSUs that are earned vest over a three-year period commencing on the first anniversary of the date of grant, subject to continued employment, thereby further enhancing shareholder alignment as well as long-term commitment to the organization.

| | |

Key Features

| | • PSUs are earned based on one-year performance metrics (which metrics are intended to build toward long-term strategic initiatives), and subject to a 3-year vesting period following the grant date (with 1/3rd vesting on the first anniversary of the grant date and 1/3rd on each of the second and third anniversaries thereof). Earned units vest in equal increments subject to continued employment, even though the applicable performance goals were met

• Subject to a maximum award amount

• This structure provides for a longer period of shareholder alignment, and an additional retention element, because the shares underlying the PSUs are not issued until the vesting term has been satisfied (i.e., both the performance and service elements have been satisfied).

|

| | | | | | | | |

2023 Proxy Statement | | |  | | | | 53 | |

The CEO (for the CFO, at the discretion of the Compensation Committee) receives cash in respect of any Performance Stock Units earned above target, subject to the service-based vesting requirements described above.

Performance Share Units Earned (Granted in January 2022 and Earned effective December 31, 2022)

Based upon the achievement of the Performance Stock Units Goals set forth in more detail below, the CEO earned a total of 77,782 Performance Stock Units (192.50% of target) and the CFO earned a total of 16,192 Performance Stock Units (187% of target), in each case, a portion of which settled in cash. The remaining portion of the Performance Stock Units will only be settled (i.e., paid) to the recipient to the extent the time-based vesting requirements are satisfied on each of the second and third anniversaries of the grant date. The Corporate Secretary does not participate in the Performance Share Units Plan.

Commencing in 2023, in response to shareholder feedback, the Compensation Committee is introducing a new long-term performance award into the executive compensation program, which will be eligible to be earned based on achievement of an ROIC performance goal measured over a three-year period. The Multi-Year Award is being granted to the CEO and certain other key officers of the Company. The Multi-Year Award was designed based on feedback receivereceived by shareholders and is intended to better align executive performance with the Company’s long-term strategy and shareholder interest.

Restricted Stock Award

In 2022, the CEO and CFO did not receive any Restricted Stock Awards (except performance based TSR Shares described above). The Corporate Secretary receives his long-term equity-based compensation awards in the form of restricted shares that vest over time. In 2022, he received a long-term equity incentive award in the form of restricted shares on February 11, 2022, the number of which was determined by applying a multiplier of 1.0 to his annual cash incentive for 2021, which was $122,960, and dividing the product by $127.59, which was the value of our shares on the grant date. Based on this calculation, he was granted 964 restricted shares, with restrictions lapsing ratably over four years.

| | | | |

54 | |  | | 2023 Proxy Statement |

| | |

|

Key Components of 2022 CEO and CFO Compensation(1) |

| | | | | | | | |

| | | |

Compensation

Element | | Settled In | | Key Design Features | | Objective |

| | | | | | | | |

| | | | |

Short-Term | | Base Salary

| | Cash | | • Aligned with peers, taking into account business complexity and industry experience

| | • Rewards the skill and expertise that our CEO and CFO contribute to the Company on a day-to-day basis

|

| | | | | | | |

| | | | | | | |

| Annual Cash Incentive

| | Cash | | • For 2022, based on 100% on Adjusted EBITDA less CAPEX

• No award earned unless threshold level performance is achieved

| | • Focus on efficient and profitable operations, preservation of shareholder value, improvement in competitive position, and ability to further capitalize on opportunities for growth

• Adjusted EBITDA metric is a primary method used by analysts for evaluation of common shares

• Furthers shareholder alignment by placing significant annual compensation at risk

|

| | | | | | | | |

| | | | | | | | |

| | | | |

Long-Term | | TSR Shares

| | Equity | | • Earned based on relative TSR performance over the three years following grant date

• No shares earned if relative performance is below the peer group 30th percentile

• Capped at target if absolute TSR is negative

• Maximum payout for CEO is capped at 5x the grant date value

| | • Furthers shareholder alignment by tying significant compensation to achievement of strong relative total return performance over a multi-year period

|

| | | | | | | |

| | | | | | | |

| Performance Stock Units

| | Equity | | • Earned based on achievement of applicable performance goals set at or near the grant date

• Shares only earned if applicable performance criteria established for the performance period have been achieved

• Target awards vest equally over a three-year term subject to continued employment with the Company; above target settled in cash (for CFO, at Compensation Committee’s discretion)

| | • Furthers shareholder alignment by tying significant compensation to achievement of strategic objectives critical to long-term growth

|

| | | | | | | | |

(1) | Throughout this Proxy we reference non-GAAP measures, such as “Adjusted EBITDA”, “Adjusted EBITDA less CAPEX” and “net debt”, and other measures against which we gauge performance, liquidity, and compensation. Please refer to Annex A for an explanation and reconciliation of these non-GAAP measures.

|

| | | | | | | | |

2023 Proxy Statement | | |  | | | | 55 | |

Performance Goals

The Compensation Committee approved performance goals and metrics for each of the CEO and CFO in December 2021 for the 2022 performance period in accordance with its normal practices. The goals for the CEO and CFO served as the basis for setting performance goals and metrics of business units, and included financial and operational performance goals and metrics which were designed to improve Company performance in a manner that would maximize shareholder value over the long term.

| | |

|

2022 CEO Goals and Metrics |

| | | | | | | | | | |

| | | | | |

Compensation

Element

| | | | Weight | | | | Goal and Metrics | | |

| | | | | |

Annual Incentive

Plan Goal

| | | | 100% | | | | Adjusted EBITDA less CAPEX | | • Threshold: $256M

• Target: $366M (vs. actual of $307M achieved in 2021)

• Maximum: $439M

|

| | | | | | | | |

Performance Stock Unit Goals

| | | | 15% | | | | Short list internal candidates for succession planning and develop individualized plans. |

| | | | | |

| 30% | | | | Achieve at least $200 million reduction in net debt (excluding SANAD-related distributions and expenditures required to be incurred in 2022, or change in accounting regarding the accounts receivable facility) |

| | | | | |

| 15% | | | | • Achieve a reduction in drilling carbon intensity GHG emissions versus 2021 with a one year 7.5% reduction in US Land business and a 5% reduction in International Nabors rigs

• Improve US employee SGA and FS diverse representation by 10%

|

| | | | | |

| 25% | | | | Achieve 2022 Adjusted EBITDA for NDS of $90M |

| | | | | |

| 15% | | | | Prepare a detailed energy transition business plan, including specific marketing plan and goals, capital requirements in 2022 and the expected financial returns for each product line |

| | |

|

2022 CFO Goals and Metrics |

| | | | | | | | | | |

| | | | | |

Compensation

Element

| | | | Weight | | | | Goal and Metrics | | |

| | | | | |

Incentive Plan Goal

| | | | 100% | | | | Adjusted EBITDA less

CAPEX

| | • Threshold: $256M

• Target: $366M (vs. actual of $307M achieved in 2021)

• Maximum: $439M

|

| | | | | | | | |

Performance Stock Unit Goals

| | | | 15% | | | | Short list internal candidates for succession planning and develop individualized plans. |

| | | | | |

| 30% | | | | Achieve at least $200 million reduction in net debt (excluding SANAD-related distributions and expenditures required to be incurred in 2022, or change in accounting regarding the accounts receivable facility) |

| | | | | |

| 25% | | | | Finance organization efficiency and cost objective |

| | | | | |

| 30% | | | | Analysts, investors and rating agencies objective |

| | | | |

56 | |  | | 2023 Proxy Statement |

2022 Performance Achievements

Assessment of 2022 Annual Cash Incentive Award Achievement

For 2022, our CEO’s and CFO’s annual cash incentive award was based on a new financial metric, namely, “Adjusted EBITDA less CAPEX”. In 2021, the CEO’s and CFO’s annual cash incentive was based solely on Adjusted EBITDA. “Adjusted EBITDA less CAPEX” is a significant consideration used by investors and analysts in evaluating the Company and is therefore, we believe, a key driver of the Company’s share price. Building upon our use of Adjusted EBITDA as a financial metric to drive performance, “Adjusted EBITDA less CAPEX” is in line with our financial discipline to target our capital spending to higher margin, lower capital-intensive business segments. All references to “CAPEX” in these measures excludes SANAD new build rig capex.

| | | | | | | | | | | | | | | | |

|

2022 Performance Achievements |

|

| | | | | | | | |

Objective | | | | Weight | | | | Target Ranges | | | | Performance Achieved | | | | Cash Incentive Earned |

Adjusted EBITDA(1) less CAPEX

| | | | 100%

| | | | • Threshold: $256M

• Target: $366M

• Maximum: $439M

| | | | The Company’s Adjusted EBITDA less CAPEX for 2022 was $419M versus $307M in 2021 which represents a 36% increase

| | | | Because the actual performance exceeded target payout levels, the cash incentive was earned at approximately $3M for the CEO and approximately $1.3M for the CFO.

|

Our Corporate Secretary’s annual cash incentive is based on the achievement of quantitative and qualitative performance goals established at the beginning of the annual performance period. For 2022, his performance goals included enhancements to the Company’s stock plan administration program, targeted shareholder outreach, and improvements to corporate governance and compliance programs. His cash incentive for 2022 was $150,700.

Assessment of 2022 Performance Stock Units Achievement (Granted in January 2022 and Earned in 2022 Based on 2022 Performance)

For the 2022 performance cycle, our CEO had five performance goals as set forth in the table below. Consistent with the request of shareholders, the goals are weighted more heavily toward financial performance.

| | | | | | | | |

2023 Proxy Statement | | |  | | | | 57 | |

CEO Performance Goals and Assessment

| | | | | | | | | | | | | | | | | | |

|

| 2022 CEO Performance Achievements |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | Performance Goal and Rationale | | | | 2022 Progress | | | | Degree of Achievement Determined | | | | | Goal Weighting |

| | | | | | | | | | | | | | | | | | |

1 | | | | Short list internal candidates for potential executive succession, circulate a detailed development plan appropriate for candidates and provide this to the Board no later than May 15, 2022; and Commence the individualized plans no later than June 1, 2022, and report progress to the Board quarterly through December 31, 2022. Identify training gaps as of December 31, 2022, to be closed during 2023. Rationale: To identify high-performing internal candidates and create an executive development program designed to produce viable successor candidates. | | | | Completed Completed | | | | 100% | | | | | | 15% |

| | | | | | | | | | | | | | | | | | |

2 | | | | Achieve at least $200 million reduction in adjusted net debt (excluding any SANAD distributions of cash to our partner, and any SANAD new rig CAPEX). Rationale: Part of long-term corporate objective to reduce financial leverage and associated risks and increased shareholder value. Actual net debt reduction achieved in 2021 was $216 million. | | | | Achieved adjusted net debt decrease by $287.2M, excluding SANAD-related distributions and expenditures of $101.1M, during the year, resulting in a $186M reduction in net debt from $2.271Bn down to $2.085Bn. | | | | 100% | | | | | | 30% |

| | | | | | | | | | | | | | | | | | |

3 | | | | Achieve a reduction in drilling carbon intensity GHG emissions with a one year 7.5% reduction in the US Land business and a 5% reduction in International Nabors rigs. Improve US employee SGA and FS diverse representation by 10% with a target of 41% for US employees and 36% for Leadership (Director and above – Houston only). Rationale: Align business objectives and performance with broad stakeholder base and a specific response to shareholder request to tie executive compensation to ESG goals. | | | | We achieved a one-year reduction in GHG emissions intensity of only 1.2% vs. 7.5% target on the US Lower 48 rigs and 15% reduction vs. 5% target on Nabors’ international rigs Achieved 5% targeted improvement in diversity for employee level, and 5% targeted improvement in diversity in Leadership | | | | 75% | | | | | | 15% |

| | | | | | | | | | | | | | | | | | |

4 | | | | Achieve 2022 Adjusted EBITDA for NDS of $90M. Rationale: Increase profit in this low capital intensity, high margin business. Actual Adjusted EBITDA for NDS in 2021 was $59.4M. | | | | Adjusted EBITDA for NDS for 2022 was $98.7M, representing an improvement of 66% over prior year | | | | 100% | | | | | | 25% |

| | | | | | | | | | | | | | | | | | |

5 | | | | Prepare a detailed energy transition business plan. Plan should include specific marketing plan and goals, capital requirements in 2022 and the expected financial returns for each product line. Rationale: To create an effective strategy for growth, determine future financial needs and attract investors and lenders to our growing energy transition business segment. | | | | Business plan was provided to the Board, and it was determined by the Board that it met the criteria of the goal set. | | | | 100% | | | | | | 15% |

| | | | | | | | | | | | | | | | | | | |

The overall percentage achieved is the weighted average of the percentage completed for each goal, or 96.25%. As a result of the 96.25% achievement level, the Compensation Committee determined that 192.50% of the target amount of 40,406 Performance Stock Units originally granted to our CEO on January 1, 2022, or 77,782 Performance Stock Units in total, were earned. The initial 40,406 Performance Stock Units vest into common shares in three annual installments, with the first installment of 13,469 shares having occurred on January 1, 2023. The balance of the Performance Stock Units were settled in cash.

For the 2022 performance cycle, our CFO had the 5 performance goals set forth in the table below. Consistent with the request of shareholders, the goals are weighted more heavily toward financial performance.

| | | | |

58 | |  | | 2023 Proxy Statement |

CFO Performance Goals and Assessment

| | | | | | | | | | | | | | | | |

|

| 2022 CFO Performance Achievements |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | Performance Goal and Rationale | | | | 2022 Progress | | | | Degree of Achievement Determined | | | | Goal Weighting |